This is a 6-minute read on why DeFi applications built atop layer 1 infrastructure — i.e. ETH, DOT, SOL should seriously consider using UST stablecoin by Terra as their base currency. Failure to do so can lead to dire consequences. In addition, I will distill 3 main reasons why Terra Luna may be the single closest bet poised to bring mainstream adoption into cryptocurrency.

If you’re new to Terra Luna, read this in-depth beginner’s guide on the Terra Luna ecosystem before continuing.

Creating an algorithmic decentralised stablecoin from scratch is no easy feat and the cost of failure is high.

Everything is all fun and games until the music stops.

Building dApps around an algorithmic stablecoin requires trust in the mechanism, but building a centralised stablecoin requires trust in the company that runs it.

Risk of Centralised Stables

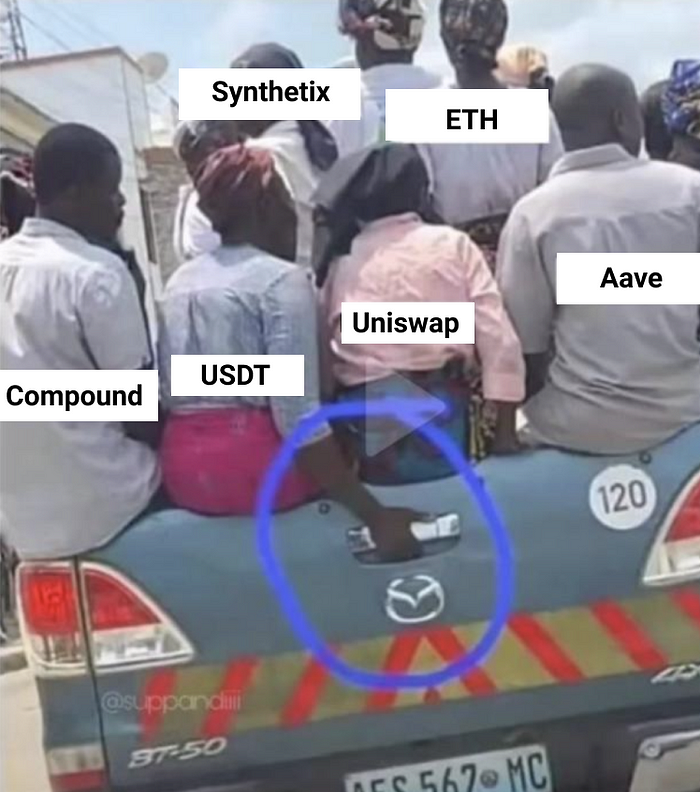

The top 3 stables – USDT, USDC, and BUSD – are centralised entities, where users have to trust that each digital token minted is backed by a real dollar. Users’ comfortable demeanor toward these centralised stablecoin, poses a large systemic risk to the entire DeFi ecosystem. Regulation, state-level attacks, or simple negligence by centralised stablecoin issuers can lead to assets being frozen and/or significantly devalued. Under such attacks, any DeFi protocol that relies upon these assets as part of liquidity pools or as collateral would face potential insolvency — read USDT SEC lawsuit.

In other words, projects can build the best decentralised DeFi ecosystem, and yet their heavy reliance on these centralised stablecoins with deep liquidity could mean their demise if they get shut down.

Fundamentally, there’s no point in having a censorship-resistant base layer blockchain if its applications are built around easily censorable assets.

Risk of Decentralised Algo Stables

Algorithmic stablecoins remain an experiment. Many have tried and failed. Past algorithmic stablecoins did not manage to survive extreme volatility — read the recent case study on TITAN Iron Finance.

One can also argue that we already have $DAI, the largest decentralised stablecoin. $DAI, while widely adopted, can only be minted if users open a leveraged position, which limits its ability to scale exponentially. Moreover, $DAI has been partially collateralised by centralised, censorable assets ($WBTC, $USDC) and thus inherits their vulnerabilities.

Unlike Terra’s predecessors, Terra has shown the ability to survive the recent black swan event, which stress-tests its ability to maintain peg on 19 May 2021. The core team has also taken swift measures to strengthen its algorithmic design to improve price stability.

“Terra does the opposite of what most algorithmic stablecoins have done. Instead of developing a currency within an established network (e.g. Ethereum blockchain), Terra has built its own country from the ground up. As such, Terra can incorporate nuances into its system that no other existing algorithmic stablecoin can do. For example, by integrating LUNA validators into the UST peg stability equation, Terra has created a resilient community borne out of faith, game theory, and technology.

On top of that, Terra can generate demand for UST through its native applications and its network of partnerships (e.g. Terra Alliance). What most algorithmic stablecoin projects also fail to achieve is to create demand for their stablecoins. If there is no demand other than speculation and liquidity mining rewards, de-pegging will eventually occur once high yield APYs diminish. No matter how complex the design mechanics are, there is no use case if no one uses it.” — Benjamin Hor (Analyst at Coingecko)

Terra Luna uses the Cosmos Tendermint consensus to build their own heterogenous blockchain, that allows them the freedom to set their own rules and logics, away from the mandatory concepts of gas metering, gwei and fees paid based on computation efforts dictated within the Ethereum blockchain. On one hand, this allows Terra Luna to scale competitively – offering transaction fees of as low as $0.0001 and a high transaction throughout of up to 1,000 tps. On the other, it is able to scale its blockchain to be highly performant outside of a smart-contract specific framework. – Matthew Ong

How does Terra make a giant leapfrog from zero-to-one?

What makes Terra Luna stand out is its relentless focus on building for retail.

In the very few months of observing the crypto space via Twitterverse, I’ve noticed a trend of DeFi projects getting too caught up with the notion of creating the next most decentralised protocol, the best DAO, or the highest yield-bearing products to attract existing crypto-native users without pausing to ask the most fundamental question – who are the real users we are trying to attract in the long run? Where do we want crypto to be in the near future?

If our goal as a community is to attract more mainstream adoption, our obsession shouldn’t be fixated on those vanity features but doubling down on how we can do things fundamentally better.

For example, if I’m a decentralised exchange (DEX) trying to convince one to switch from a centralised exchange (e.g. Binance), what is the actual value that one would gain from using a DEX? 5–10x cheaper transaction fees? The instant transaction finality with little or no price slippage? Or how about trying to convince one to switch from Robinhood or Interactive brokers to a crypto decentralised exchange? Are we able to offer 24/7 trading with lower fees and a 100% guarantee, that their money is safe and is backed by a reputable insurer? The goal is to focus on lynchpin features that crypto skeptics really care about before decentralising over time. — More on why decentralisation isn’t as important as you think here.

“99% of DeFi projects are building for crypto natives. 1% are building for the mainstream, non-tech savvy. This ratio needs to change.” — Qiao Wang

Terra’s Moat

1. Building for Mainstream Retail

Since the advent of their white paper in 2019, Terra’s sole mission is to expand the use-cases of its stable digital currencies for mainstream users, so that it encourages users to use the services more and over time, be evangelists for the platform.

The core leadership team is also intentional in how they spend their time identifying promising projects to mentor or collaborate with, to create mass retail adoption. This maximises their impact and demand for their stablecoins (UST) and in return, benefits the entire ecosystem. The beauty behind Terra’s tokenomics is that as Terra gets more widely adopted, there is a linear relationship to how the LUNA token grows. Unpack the design mechanics of Terra Luna Stablecoin here.

Notable tractions built:

1. Chai Payments (launched 2019):

One of the fastest-growing e-wallet platforms integrated across multiple e-commerce merchants in Korea.

Value:

1. Merchant fees of 1.1–1.3% compared to 2–3% from VISA/Mastercard

2. Merchants get paid in 6 seconds compared to the average settlement time of 3–14 days

Traction:

1. Acquired 2.7million users with 80k daily active users

2. Processed $1,000,000,000 e-commence transactions since inception

2. Mirror Protocol (Launched Dec 2020)

Allows anyone to gain exposure to on-chain synthetic assets (e.g. equities, commodities, indices) on a blockchain.

Value:

1. No central entity with the power to pause/restrict trading on any asset

2. Users in developing countries who don’t have access to such products.

Traction:

1. 100% M-o-M liquidity growth from Dec 20 to date with >20,000 daily active users and average daily trading volume of >50 million UST

2. TVL: 2 billion dollars

3. Largest user base; 28% from Thailand

3. Anchor Protocol (Launched Mar 2021):

Anchor’s long-term goal is to become the “Stripe for Savings” for mainstream users, with a fixed 20% APY on UST stablecoin.

Value:

One of the highest saving yields on stable in both crypto and conventional banks.

Traction:

Total deposit: $350 million UST.

2. Strategic Partnership & Alliance

Terraform Lab has been developing business relationships with key players in both the e-commerce industry and the online-to-offline (O2O) industry from the get-go. As a result, the Terra Alliance was formed, which consists of 15 companies including huge Asian backers such as TMON and Yanolja. For some context, TMON is one of the largest e-commerce players in South Korea while Yanolja is South Korea’s largest travel platform.

Before launching UST, Terraform Labs launched two precursive stablecoins: TerraKRW (pegged to the Korean Won) and TerraMNT (pegged to the Mongolian Tögrög). Notably, Terra has partnered with the Mongolian government which will accept TerraMNT as currency for certain services like utilities.

3. Unified Design System

In a recent podcast with Arkinvest, Do Kwon emphasised the importance of creating a unified design system and guidelines across all dApps building on top of Terra Luna Infrastructure. This is similar to the iOS human interface by Apple, and the Material Design Guidelines by Google so as to maintain a consistent user experience, which will be available in the near future.

As a user experience designer, this spoke to me in two folds:

№.1 // It creates a consistent and familiar user experience while interacting with the dApps. This reduces user friction from the on-ramp and establishes trust quicker.

№.2 // A set of best design practices established with folks from IDEO, helps both designers and developers speed up their workflow and create a more consistent user experience.

Closing Thoughts

At the time of writing, Terra’s DeFi ecosystem has already attracted >$2 billion TVL with 3 solid protocols – Chai, Mirror V2, and Anchor. With the next 30+ projects set to launch in Q3/Q4 of 2021, I can’t begin to imagine the amount of demand that would create for UST

In the next 6–12 months, I’m positive that $LUNA is in a position to potentially overtake USDT / USDC in market cap and veer towards being the top contender. My only wish is that I had dug deeper into Terra’s ecosystem earlier.

I’ll continue building my conviction and knowledge vault of Terra’s Ecosystem.

Useful References:

https://flexiple.com/blog/what-are-stablecoins-and-how-do-they-work/#section1

https://coinmarketcap.com/alexandria/article/luna-bound-exploring-the-terra-ecosystem

https://medium.com/coinmonks/the-moonshot-case-for-terra-luna-7759f2015335